Couple Sues Talisman

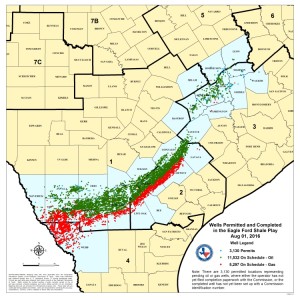

The Eagle Ford’s DeWitt County is at the center of a royalty dispute over unpaid royalties for one couple.

Related: Repsol to Aquire Talisman Energy

Eugene and Kimberly Cran, have taken their complaints to court, filing lawsuit against Talisman Energy (Repsol) earlier this week. The couple claims they were underpaid for their royalties for oil wells on their land in DeWitt County.

The Crans had entered into a lease with both Talisman and StatOil USA. They became suspicious when their royalty checks from Talisman were consistently lower than those from StatOil. The couple turned to the courts when they could get no reasonable answers from the company.

“The suit alleges that Talisman “systematically failed and refused to pay Plaintiff(s) the full royalties due and owing according to their mineral rights and leases.”

The Provost Umphrey Law Firm LLP represents the Crans and more than 100 royalty owners in the Eagle Ford. They expect to file more royalty payment lawsuits again Talisman over the next few weeks.

Talisman became a casualty of the crude pricing crisis. After a devastating $1.59 billion loss in the fourth quarter of 2014 and announcements of major job cuts, the company was sold to Repsol in 2015 for $8.3 billion.