In SM Energy's second quarter earnings report released this week, the termination of the drilling and completion carry with its joint venture (JV) partner, Mitsui, was confirmed.

SM Energy is now responsible for funding its proportionate share of drilling and completion costs in the area. An increase in SM Energy's capital guidance for 2014 was announced in the company's first quarter earnings report to accommodate for the additional costs.

Mitsui's $680-million carry commitment in the Eagle Ford provided needed capital funding to accelerate SM's development in the play. SM Energy and Mitsui entered their Eagle Ford joint venture agreement in 2011.

Read more: SM Energy-Mitsui Eagle Ford Carry Will End in Q2 2014

SM Energy Eagle Ford Non-Operated Acreage Update

Net production in SM Energy's non-operated portion of its Eagle Ford shale program for the second quarter of 2014 averaged 23,800 boe/d. That's a 2% sequential increase over the first quarter of 2014 and a 37% increase year-over-year.

The operator made approximately 95 flowing completions during the second quarter.

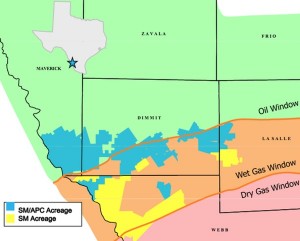

SM Energy Eagle Ford Update in Operated Acreage

During the second quarter, SM Energy made 23 flowing completions in its operated Eagle Ford Shale program. The company's operated net production in the Eagle Ford shale averaged 83, 200 boe/d in the second quarter of 2014. That's a 9% sequential increase from the previous quarter and a 26% increase year-over-year.

SM Energy Sand Loading Tests Yield Positive Results

SM Energy has been shifting its Eagle Ford drilling and completion program toward longer lateral wells and completions with higher sand loading. Company officials say longer lateral testing is ongoing, but sufficient data on SM's increased sand loading tests is now available from wells in Area 2 of SM's operated Eagle Ford shale position to conclude that wells completed with higher sand loadings are more productive and have improved initial condensate yields.

Read more at sm-energy.com