A small Christmas gift from the Eagle Ford Shale drilling rig count that jumped to 267 active rigs last week. Thats a new record for drilling in the area (again). The previous high was 264 set during the week of November 18, 2011. With most companies adding rigs in the new year, don't expect this record to last long. 245 of the 267 rigs are drilling horizontal wells. Vertical drilling now accounts for less than 10% of all drilling in the area (mostly non-Eagle Ford). Oil prices recovered a bit over the past week (close to $100/bbl) and gas prices remained weak. The January natural gas contract is bouncing around $3/mmbtu (Henry Hub), but the natural gas rig count grew two rigs to a total of 95 rigs working the play. While $3 gas isn't adding incremental development, the Eagle Ford rig count will remain dependent on liquids prices.

The number of oil rigs working increased by 10 to reach a total of 172.

Webb (37) still leads the region, while Karnes (35), La Salle (34), McMullen (26), DeWitt (25), Dimmit (24), and Gonzales (19) round out the top counties in the area. All but McMullen added rigs during the week.

Hess Corporation added its first Eagle Ford operated rig. The unit is running in La Salle County, TX. Hess is one of the largest operators in the Bakken Shale in North Dakota.

Stay tuned for updates on the South Texas drilling rig count.

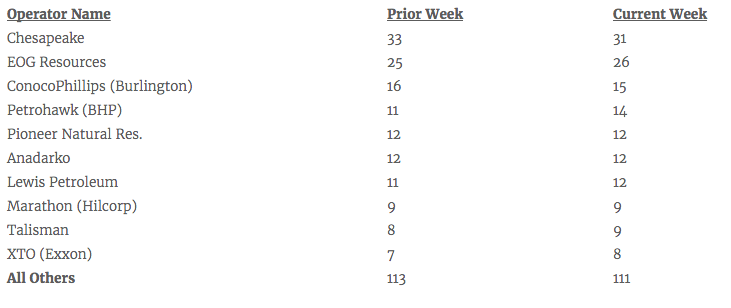

Drilling Rig Count by Operator

What is the Rig Count?

The Eagle Ford Shale Rig Count is an index of the total number of oil & gas drilling rigs running across a 30 county area in South Texas. The South Texas rigs referred to in this article are for ALL drilling reported by SmithBits and not solely wells targeting the Eagle Ford formation. All land rigs and onshore rig data shown here are based upon industry estimates provided by the Baker Hughes Rig Count and/or Smith Service Co's (Schlumberger) Smith Rig Count.

Drilling Rigs by County