The Eagle Ford Shale drilling rig count grew to 271 this past week. News this week built on what we heard last week when several operators discussed drilling efficiencies and dropping rigs in response. Chesapeake highlighted its success in lowering well costs by 15% through drilling time improvements and other oilfield service costs. The company also plans to drop from almost 33 rigs running in the first half of the year to 25 at year-end and 22 for 2013. The company is also working off a backlog of 220 wells that have been drilled, but have not been brought to production.

Read our coverage of Chesapeake's quarterly release in the article Chesapeake Will Run 22 Eagle Ford Rigs in 2013.

Eagle Ford Oil & Gas Rigs

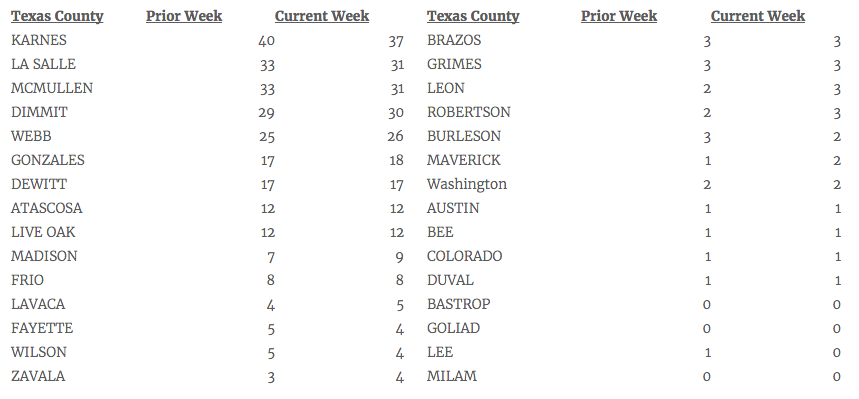

The number of natural gas rigs (Smithbits) stands at 59 this week, up one from last week. For the eighth week running, the only counties with over ten rigs targeting natural gas are Karnes and Webb. There are 210 oil rigs working, which ties the record set in April 27th.

Henry Hub futures were trading at ~$2.78 on Friday afternoon. That's a drop of almost 10% over the past three weeks. Notably, spot prices (physical prices today) are off, but still closer to $3 at $2.96 per mmbtu.

WTI was trading at ~$93/bbl Friday afternoon and LLS crude prices are just above $110/bbl. As I've mentioned several times before, if prices continue to rise we'll likely see additional drilling capital committed to the area.

There are 247 horizontal rigs running in the region. The three counties leading development are Karnes with 36 rigs, McMullen with 32 and La Salle with 31. Dimmit (29), Webb (20), DeWitt (19), Gonzales (17), Atascosa (12), Live Oak (11), and Frio (10) round out the top Eagle Ford counties.

News items this week included:

- Plains All American & Enterprise Products Announce Eagle Ford Joint Venture

- Magnum Hunter Adds Pearsall Shale & Eagle Ford Properties

- Rosetta Resources Plans Eagle Ford Development at 55-Acre Spacing

- Plains Exploration Grows Eagle Ford Production Ten Fold Year Over Year

Come back weekly for updates or sign up for alerts.

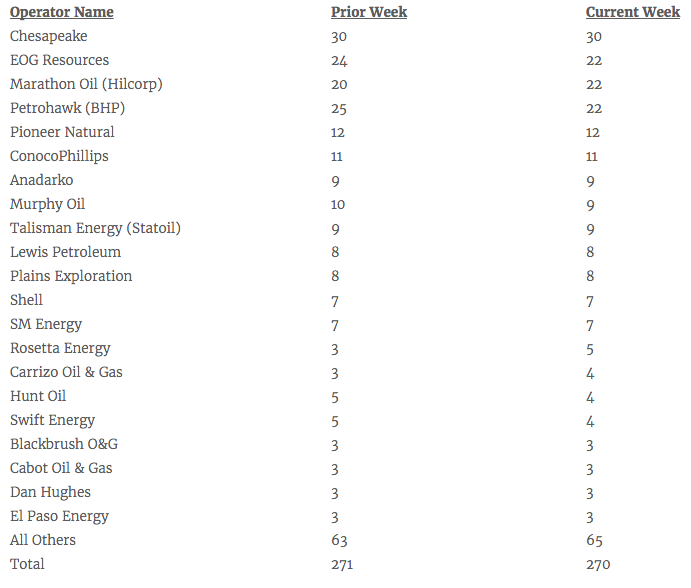

Drilling Rig Count by Operator

What is the Rig Count?

The Eagle Ford Shale Rig Count is an index of the total number of oil & gas drilling rigs running across a 30 county area in South Texas. The South Texas rigs referred to in this article are for ALL drilling reported by SmithBits and not solely wells targeting the Eagle Ford formation. All land rigs and onshore rig data shown here are based upon industry estimates provided by the Baker Hughes Rig Count and/or Smith Service Co's (Schlumberger) Smith Rig Count.

Drilling Rigs by County