Sabine Oil & Gas Corp. became the largest U.S. oil producer to file for Chapter 11 bankruptcy protection this week, making it the sixth producer to take this action since the first of the year.

This decision follows months of speculation as Sabine struggled to pay creditors.

Related: Repsol Moves into the Eagle Ford

Since the decline in oil prices, there have been mergers, acquisitions and layoffs, but not as many bankruptcies as expected. But some analysts warn that this is just the tip of the iceberg and are forecasting more bankruptcies later in the year.

“Operations have been significantly impacted by the recent and dramatic decline in oil prices, the continued low prices of natural gas, and general uncertainty in the energy market. Sabine continues to evaluate and discuss alternatives with its stakeholders and believes that its in-court financial restructuring will position Sabine for profitability and long-term success.”

Other U.S producers who have filed bankruptcy include American Eagle Energy, Quicksilver Resources, BPZ Resources, WBH Energy and Walter Energy.

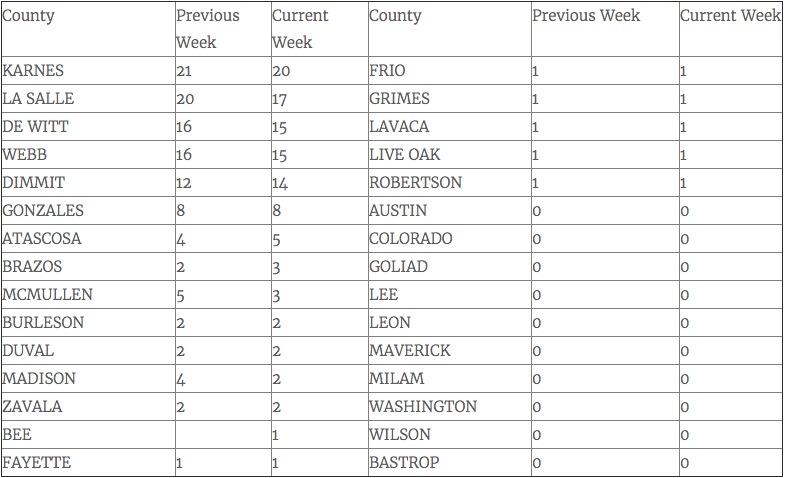

In May, Sabine reported first quarter increase of 116% for oil production over the same time last year as well as completing 15 wells across Texas. In the Eagle Ford, the company completed two wells in the Shiner Area in northern DeWitt County and southern Lavaca County which together averaged an IP30 of over 1,300 BOEPD, with 39% oil and 70% liquids.