During the first quarter of 2014, Penn Virginia added 6,400 net acres at a cost of $3,000 per acre, and in January, the company sold its Eagle Ford Shale natural gas gathering assets for $100 million in-part for reinvestment in the play.

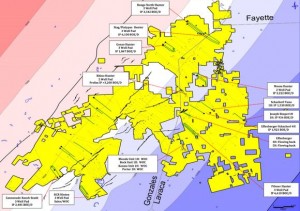

Penn Virginia currently has 125,300 gross acres (85,900 net) in the Eagle Ford, and anticipates on growing its acreage to a minimum of 100,000 net acres.

“Due to continued success in adding to our Eagle Ford Shale acreage position, we are increasing our leasing capital expenditures guidance for the year.”

It can be assumed with great confidence that Penn Virginia will strike a deal for more Eagle Ford acreage in the very near future.

Read More: Penn Virginia Sells Eagle Ford Midstream Assets to ArcLight Capital

Penn Virginia Eagle Ford First Quarter Operations Update

Penn Virginia's Eagle Ford production was up 15% quarter over quarter, from 13,145 boe/d to 15,152 boe/d at the end of the first quarter of 2014. Eagle Ford production represented ~72% of Penn Virginia's record breaking total production for the quarter of 21,133 boe/d.

During the quarter, the company saw positive results from two of its Upper Eagle Ford test wells in Lavaca County. One of the wells had an initial production (IP) rate of 2,165 boe/d. Company officials say that the two wells have the highest wellhead flowing pressures they have seen to date in the Eagle Ford, with GORs (gas-oil-ratios) of 5,000 - 6,000 standard cubic feet per barrel.

“Initial testing of our adjacent Upper / Lower Eagle Ford Shale wells commenced in the first quarter and the initial results are strong. We saw initial production in excess of 2,000 BOEPD with a very high flowing pressure. Longer term testing will be necessary in order to fully understand the upside associated with the Upper Eagle Ford Shale, but we are very optimistic about the play.”

Penn Virginia estimates in both the upper and the Lower and the Upper Eagle Ford that approximately 1,510 gross drilling locations remain. Of that figure, 68% of those locations are prospective for the Lower Eagle Ford.

During the quarter, the company completed 16 (12.9 net) operated wells and participated in the completion of two (0.9 net) outside operated wells. At the end of the quarter, the company had a total of 19 (11.1 net) wells completing or waiting on completion and six (3.4 net) wells being drilled.

Read more at pennvirginia.com