In its quarterly report, Devon Energy announced it finished an “outstanding year” as it rebounded from a $20 million net loss in 2013 to end 2014 with net earnings of $1.6 billion.

Devon's fourth-quarter total production rose 20% to 239,000 barrels per day, which represents a 48% increase from 2013.

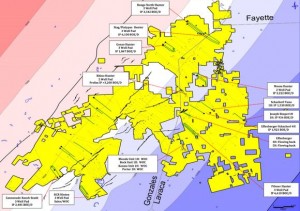

The report credits the Eagle Ford’s prolific wells for these record numbers. Devon Energy is active in over 82,000 acres in DeWitt and Lavaca counties in Texas.

Related: Devon Banking on High Returns from Eagle Ford Investment

“Devon delivered another exceptional performance in the fourth quarter, rounding out an outstanding year for the company, including a significant repositioning of the portfolio.”

ooking to 2015, Devon has significantly reduced its capital budget for next year by 20% to $4.96 billion. The company plans to slash its spending in all areas except the Eagle Ford, including a 21% cut in exploration and production. The company predicts oil production will increase 20% to 25% in 2015 and they plan to operate on 13 rigs for 2015, as compared with more than 20 rigs last year.

“With strong results from our enhanced completions and a focus on core development areas, we expect growth in oil production to be between 20 and 25 percent in 2015.”

In other Devon news, Chief Executive John Richels announced in December his plans to retire at the end of July. It is expected that their Chief Operating Officer, Dave Hager, will be named as his successor. Read more here.

Get the full report at devonenergy.com