Penn Virginia Corp. released its first quarter update last week, showing its Eagle Ford operations the big star.

Realated: Penn Virginia Upper Eagle Ford Production Taking Off

Since moving into the Eagle Ford in 2010, Penn Virginia has focused a great deal of its resources on the area. For the first quarter of 2015, the Eagle Ford accounted for 87% of the company's production (21,390 BOEPD of 24,721 BOEPD). Looking ahead, 96% of 2015 spending will go towards Eagle Ford development.

Q1 Highlights

- Total production increased 17% over the first quarter of 2014

- 25% Decrease in Average Eagle Ford Well Cost Since Early Fourth Quarter 2014

- Decrease for unit production costs: $10.68 per BOE from $11.52 per BOE.

- Over the past 12 months, 23 Upper Eagle Ford wells have been brought on line

“While continuing to increase production, our primary focus has been on cutting well costs and improving our operational execution,” said H. Baird Whitehead, President and Chief Executive Officer of Penn Virginia, in a conference call following the release. “With 23 wells completed over the past 12 months, we feel that we have successfully de-risked the Upper Eagle Ford across much of our acreage and have achieved excellent average results.”

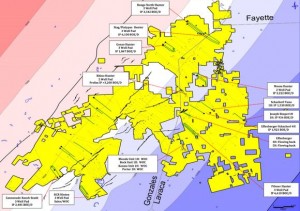

As of October 2014, Penn Virginia had approximately 145,500 gross acres in the Eagle Ford Shale play in Gonzales and Lavaca Counties, Texas. Read more about Penn Virginia in the Eagle Ford